Three Benefits of Investing in an OpenWorld Portfolio

Written by Angel Velarde

4 August 2024

Nothing shared below is financial advice.

Some of the best investors in the world rely on simple strategies to maximize their investment returns over time. The OpenWorld Portfolios use many of the same strategies available in traditional finance, automate them, and apply them to crypto to maximize returns for users.

Here are 3 reasons why the OpenWorld Portfolios are the best risk-adjusted investment tool in crypto.

1. Compounding

“Compound interest is the eighth natural wonder of the world and the most powerful thing I have ever encountered.” Albert Einstein

The OpenWorld Portfolios create a diversified portfolio of the best liquidity pool positions. These liquidity pools reward users with fees, which OpenWorld auto-compounds on a regular basis to take advantage of the power compound interest. With yields as high as 20-40% and higher on some liquidity pools, the power of compound interest cannot be understated, especially the longer that you allow an investment to grow.

2. Portfolio Balancing

A powerful, but often forgotten, investment best practice is to rebalance your portfolio on a regular basis. Regular portfolio balancing, allows you to lock in gains, lower volatility, and maximize the power of compound interest.

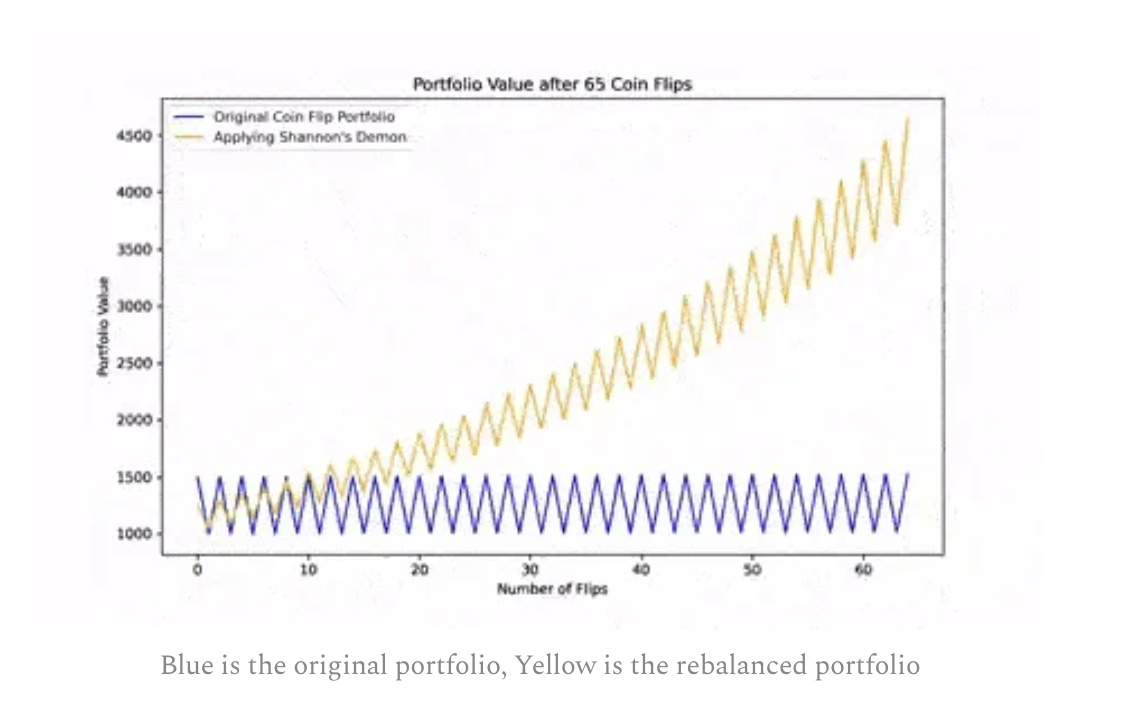

One way to view the power of balancing, is to think of a coinflip exercise, where if it’s heads, you win 50% of your bet amount; if it’s tails, you lose 33.3%. Even though the arithmetic return is positive, this game has a long-term expected return of zero. This is similar to what investors experience in their investments.

However, if after every coinflip, you rebalanced the total into 50% cash after every flip, the true effect of balancing can be seen over time. This effect was first shown by Claude Shannon and is known as “Shannon’s Demon.”

The OpenWorld Portfolios diversify your investment into a mix of the top crypto tokens and stablecoins, and keep the investment balanced at a ratio aimed to maximize returns over time.

3. Exposure to the Market

“The stock market (and almost any market) is a device for transferring money from the impatient to the patient.” Warren Buffet

The above benefits mean very little if you are invested in the wrong market. If you have made it this far into this article, you see the potential of crypto to reshape the financial world and even other aspects of the world economy. A huge value creation exercise is happening where we just need to invest into the most obvious winners and let time and compound interest make you rich. Crypto is either a multi-trillion dollar opportunity or going to zero. And at this point in the its maturity, it is looking likely that it is the former.

To maximize your returns, investors should stay invested in the market. Trying to time the market may cause you to miss market’s highest return days. For example, missing the market’s 10 best days during a 15-year period, causes investor’s return to be cut by half.

The OpenWorld Portfolios give you exposure into the greatest value creation opportunity since the internet, while earning yield on those assets which are invested in this huge potential market.

By combining these three powerful forces: compound interest, portfolio balancing, and exposure to the crypto market, the OpenWorld Portfolios provide you with the best risk-adjusted investment tool in crypto. All of these features are automatically managed on ow.finance, in addition to managing the complexities of managing liquidity and optimizing your investments.

Try it out for yourself. OpenWorld Portfolios are available on ow.finance and allow you to stake into a diversified portfolio with all of the benefits listed above, with just one token. Since it is built on Arbitrum, it takes advantage of the security and low fees of the L2 Ethereum network, to maximize your returns.

About OpenWorld

The OpenWorld Portfolios let you invest in a diversified portfolio of high-yield, low-risk liquidity pools; and do all of the rebalancing, keeping you in range, and auto-compounding. You can invest using one token, like USDT, and it will automatically diversify you into the various liquidity pools. We also offer other decentralized finance products that allow you to lend and borrow crypto.

Currently, OpenWorld operates on Arbitrum, and will soon expand to more blockchains. To contact us regarding partnerships or other opportunities, please emails us at support@owfin.io, join our Telegram community and follow us on Twitter.