This state of the market analysis for our token is somewhat special, because:

(1) This is the first time the analysis is done under the token name of $OPEN (instead of $xBlade)

(2) We are in the middle of a Series Seed. Which if it is a success, it will have a strong impact into the token price.

.

Technical Analysis

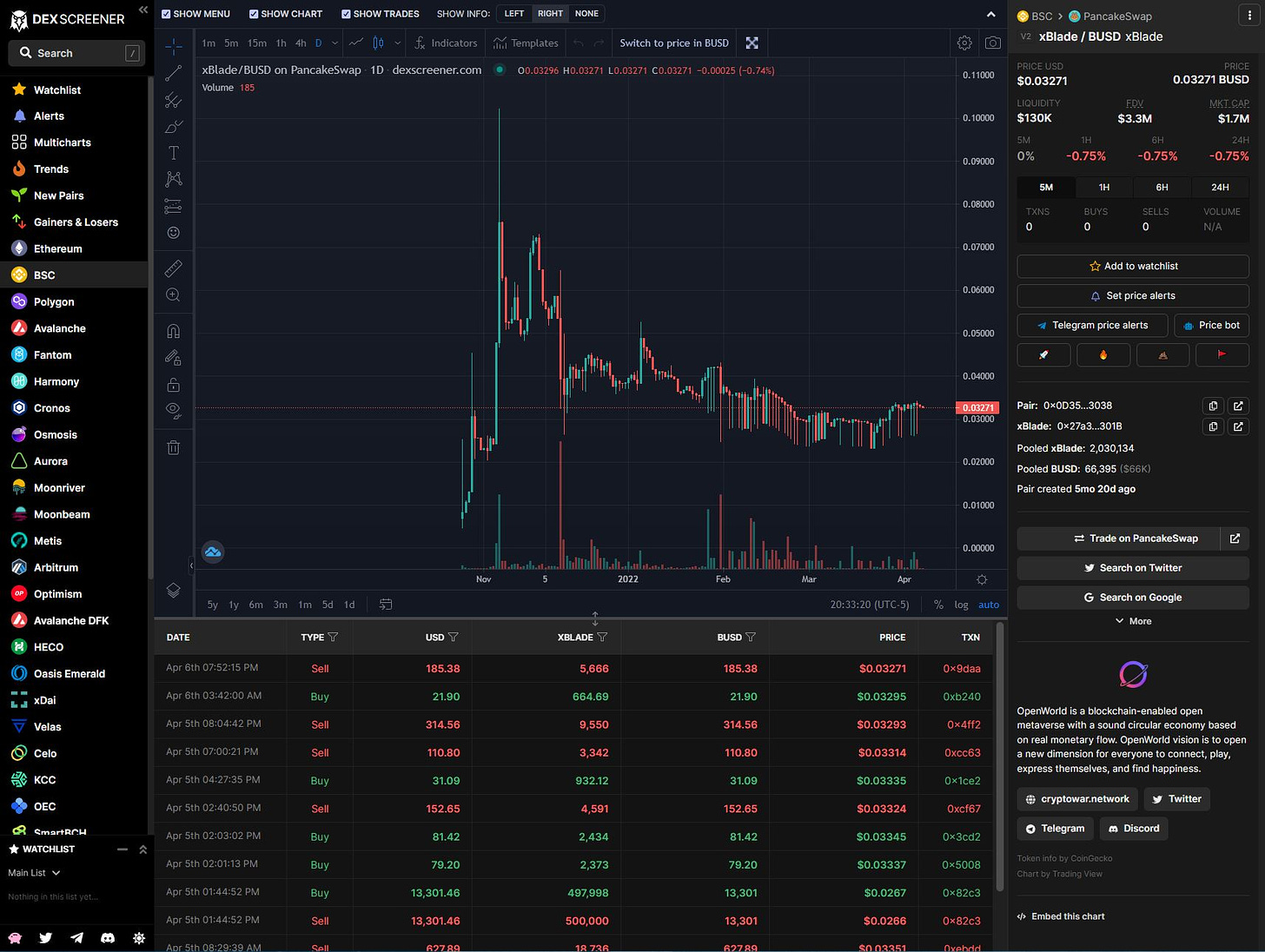

This is the snapshot of the price chart of $OPEN from Dex Screener:

Even though DEX Screener is still showing our token as $xBlade, this is because the info is probably fed from CoinmarketCap. However, BSCScan and CoinGecko have both updated our token name from $xBlade to $OPEN. You can check here for BSC Scan and here for CoinGecko.

Look from market price action, I think that the token has made trough around 0.0260 at Mar 21. Since then it has increased +26% to 0.0327. I think this is the start of a new uptrend and probably a below 0.0300 won’t be seen again. Above 0.0300, we will have 0.0380 and then 0.0420 as the next resistance.

.

Bond

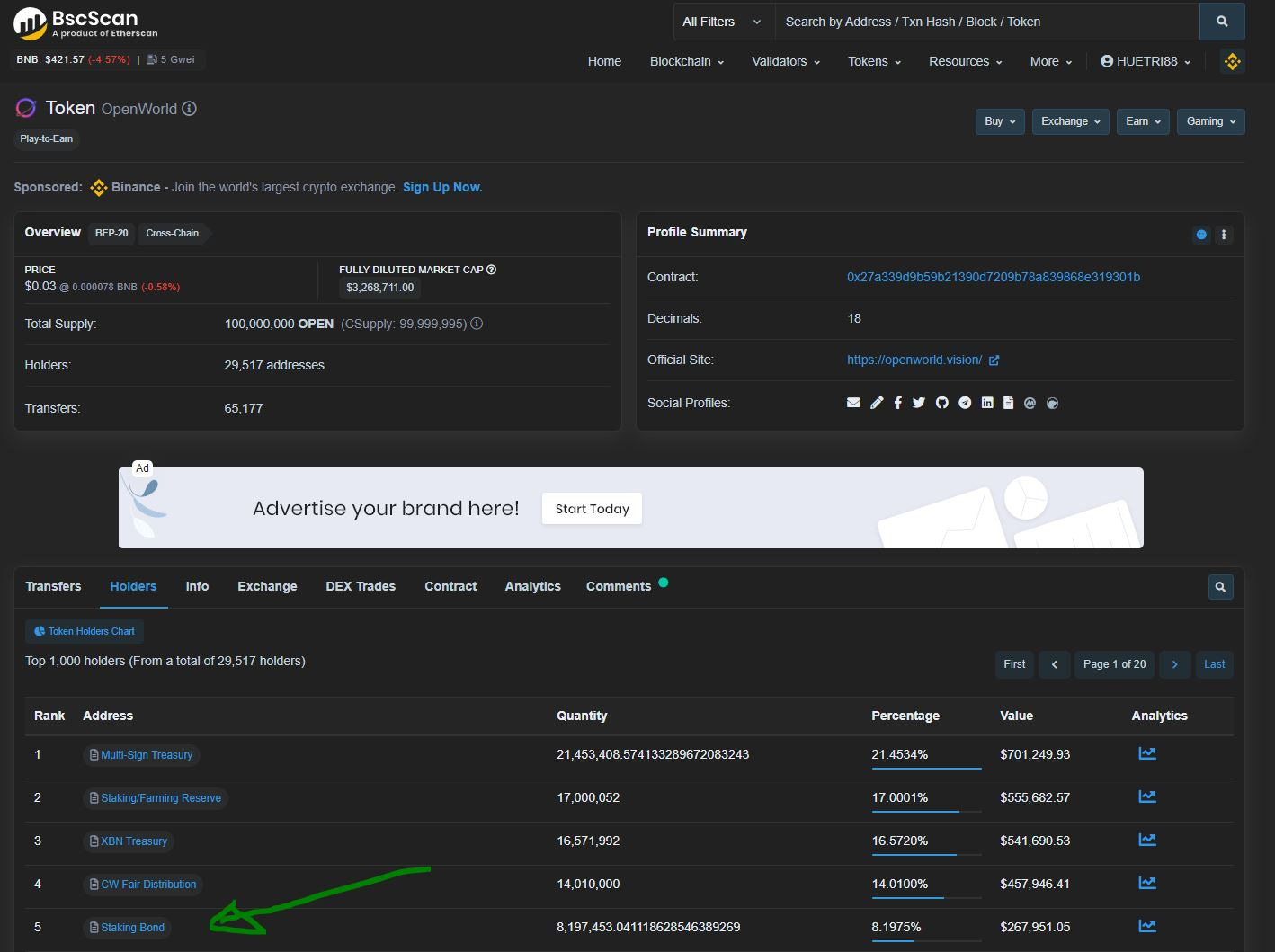

In Mar’s State of the market (here), the total Bond Purchased is $253K. To Apr, it has increased to $334K and the $OPEN single-asset staking bond 260 days is completely sold out. For BUSD 55 Days, in March, the availability is 646K $OPEN available for sales. In the first week of Apr, this number decreases to only 296K $OPEN, a decline in half. Also after this round of 55 Days Bond, we will stop selling Bond at a discount vs the market until further notice.

In Mar’s State of the market, I also made the prediction that the total locked staking probably come to the tune of 7M-8M for the months to come. Just 30 days later, we already see this total staked number climb up to 8.1M $OPEN. Even I know our community is strong and quite loyal, this comes to me as a surprise as well because this means the largest token holders are truly believers and they have no issue locking their token up for as long as 260 days. 8M token is 8% total supply. All locked in from community. Which is quite phenomenal.

This means that the float on the open market are mostly from small token holders and the downward pressure in price is very limited (as large wallets all locked in).

.

Product Developments toward Series A

Toward Series A, this is what we want to achieve within a time frame of 6-9 months:

Bridge to Harmony

Assemble an all-star top management team

Build up advisory board

Build up alpha version of OpenWorld digital world, MMORPG. Participants can start exploring our world by then

DEX

LP Staking

Single-Asset Staking

Basic economic and game mechanics for circular economy, including P2E and PvP features

Finally, one of the idea I think we are relatively strong vs comparable projects in the market is that we think we have a project concept that is quite solid in term of financial sustainability. We are not trying to build another mobile game/hyper casual game with a layer of blockchain on top. Nor we try to go after any trend whatever-to-earn. We spent a lot of time contemplating about the money flow in and out of our project and why this is something will last the next 10 years. I have no doubt that this will probably last the next 30 years if we build the digital world up successfully. This give us room to feel comfortable and not rush to the next hot trend. We will be in this idea for a very long time. Because we think digital worlds will play a very important role in internet users in the next really long period of time.

Tri

Disclaimer: Not financial advise. I hold $OPEN. I’m the Co-Founder/Co-CEO of OpenWorld. This article reflects my personal observation and thinking and not team’s official opinion.