An Introduction to DEXs (Decentralized Exchanges)

What is a DEX

Decentralized exchanges (DEXs) are peer-to-peer cryptocurrency trading platforms that allow users to exchange digital assets directly with each other without relying on a centralized intermediary (centralized exchange – CEX). DEXs use smart contracts to automate trades, providing users with secure execution guarantees and transparent trading mechanisms.

Blockchain technology is continuing to evolve, addressing challenges like scaling, user experience, and liquidity, DEXs are playing an increasingly prominent role in the cryptocurrency ecosystem. With their unique advantages, DEXs have the potential to drive greater financial inclusion, transparency, and innovation in digital asset trading.

Some examples of popular DEXs are UniSwap, SushiSwap, 1Inch, and PancakeSwap. Although the names are bit more creative than your common CEX, these DEX’s are a powerful contributer towards the crypto universe with UniSwap alone transacting more than $1.36bil and per day.

Why use a DEX

DEX’s are non-custodial: Users maintain full control over their funds and private keys throughout the trading process. We all know the term “not your keys, not your crypto”, CEX hacks, bad players simply stealing the users funds, losing access to wallets, or not forwarding airdrops can cost users a pretty penny.

Although centralized exchanges such as Coinbase, Binance, or Kraken are quite secure, they hold your money in their wallets. Additional issues can arise with CEXs delaying payments, locking assets, or governmental compliance which wrestles control of the user’s funds. In a quick changing crypto world, entry and exit points make a large difference and delays can be very costly.

Other advantages include innovative features: such as liquidity pooling, yield farming and flash loans. These products allow users to gain additional returns on the funds, generating their own fees instead of handing those profits to a bank or middleman.

For the user, DEXs typically offer lower trading fees compared to CEXs, as they do not have overhead costs of a centeral intermediary and it is the users who benefit.

Using a DEX

Upto this point, it seems clear that the user benefits more from a DEX than a CEX, but there are some challanges. Specifically the onboarding process. For Crypto beginners, downloading their own wallet, keeping their keys safe, accessing and verifying transactions and understanding terms and product use can be an uphill battle. However, once the user crosses these bridges, a world of financial opportunity awaits.

Example Uniswap - Simple ways to interact with a DEX

In this example, we assume the user already has passed the hurdle of downloading a wallet extension (Metamask, Core, Keplr, CoinbaseWallet), allowing the user to transact within a DEX ecosystem.

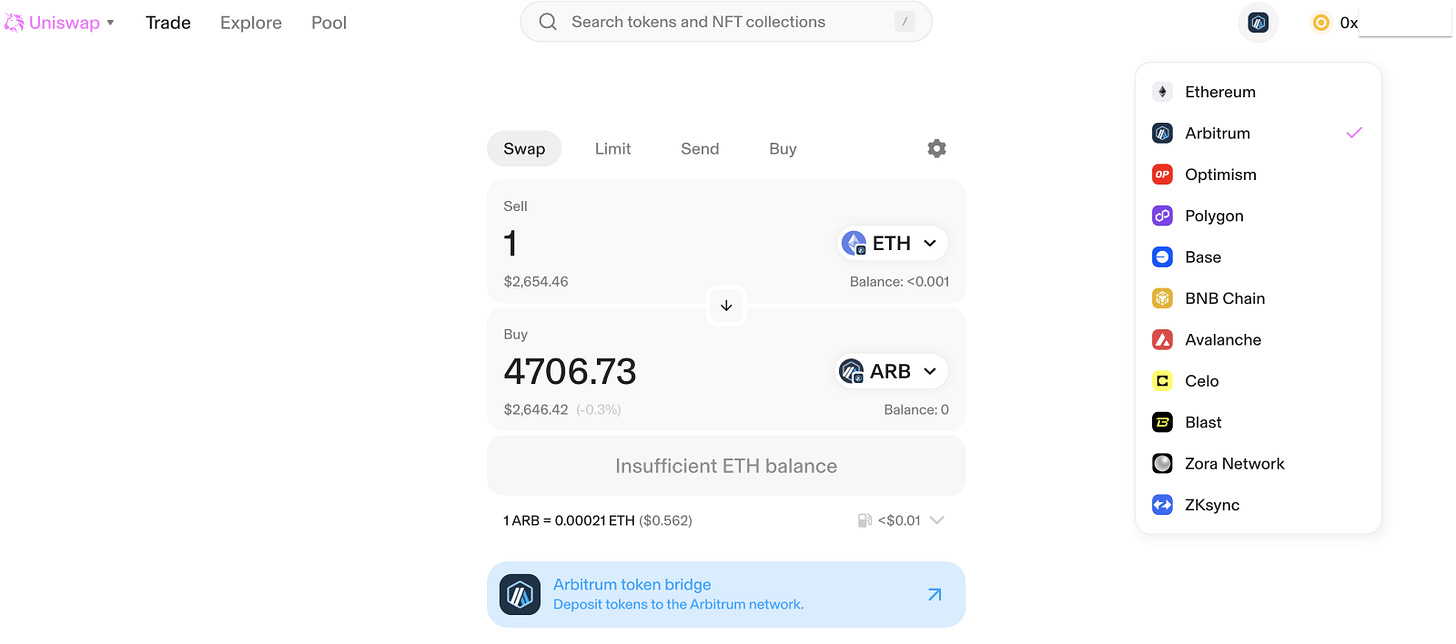

Looking at UniSwap for example once a wallet is attached (ex. Metamask), you can interact with different chains (seen in the dropbox on the right).

Using a DEX is quite simple as seen in the above example. Exchange the funds (SWAP), a pop-up asking to verify the transaction will appear. It will show the transaction details and fees. Simply click approve and our wallet will reveal its new holdings once the transaction is verified on the blockchain (within seconds).

Another advantage of a DEX is that users can also provide liquidity, which allows other users to make those SWAP transactions. See below: After an equal amount of the tokens represented in USD are deposited (ex. 1000usd worth of both OPEN and USDT), your account will now hold a liquidity token representing your invested pair.

Looking forward, your liquidity pool now gives you a portion of the fees generated when users trade that specific pair. This is because the user is acting like a bank and allowing other users to access market liquidity provided not by a centralized entity, but by any user willing to provide that said liquidity. In a decentralized system, the users, not the banks or institutions, benefit from their assets.

Impermanent loss – Understanding Liquidity Pools

There is a learning curve associated with liquidity pools and an important aspect is understanding impermanent loss. Impermanent loss occurs when a liquidity provider’s tokens in a (Uniswap) pool change value due to price fluctuations, resulting in a loss compared to holding the tokens outside the pool. There are strategies to mitigate its impact:

Monitor and adjust your pool: Regularly check the pool’s token ratio and rebalance it to maintain an optimal ratio, minimizing the impact of price fluctuations.

Diversify your liquidity: Spread your liquidity across multiple pools and tokens to reduce exposure to impermanent loss in any single pool.

Provide liquidity to stablecoin pairs: Pairs with stablecoins (e.g., USDC-USDT) tend to have lower impermanent loss due to their relatively stable prices.

Users can also focus on high-trading-volume pools, but continuously monitoring and adapting to market conditions and adjusting liquidity provisions is key.

If the reader is interested in accessing fee generation through liquidity pools, there is a product which does all the hard work for you, maximizing gains and minimizing impermanent loss. OpenWorld allows you to invest into a diversified portfolio of high-yield, low-risk liquidity pools, and rebalances your assets, keeping you in range, and auto-compounding for you. You can invest using one token, like USDT, and it will automatically diversify you into the various liquidity pools. See some easy to use options below.

Choose a pool

Choose your deposited token (ie. USDT).

Stake and your single asset (USDT) has been diversified into 5 different pools, managed, compounded and rebalanced throughout your investment period.

OpenWorld makes it simple. In one click, the user has access to the world of liquidity pooling. Enjoy a new way to invest!

About OpenWorld

The OpenWorld Portfolios let you invest in a diversified portfolio of high-yield, low-risk liquidity pools; and do all of the rebalancing, keeping you in range, and auto-compounding. You can invest using one token, like USDT, and it will automatically diversify you into the various liquidity pools. We also offer other decentralized finance products that allow you to lend and borrow crypto.

Currently, OpenWorld operates on Arbitrum, and will soon expand to more blockchains. To contact us regarding partnerships or other opportunities, please emails us at support@owfin.io, join our Telegram community and follow us on Twitter.