A Beginner's Guide to Using DefiLlama: How to Find Promising Crypto Projects

DefiLlama is a website that presents information and data related to DeFi across various blockchains, like Ethereum (ETH), Avalanche (AVAX), and Arbitrum (ARB). It provides iinformation like total value locked (TVL), protocols tools, market capitalization, audits, revenue & daily transaction fees, and more.

DefiLlama is the largest TVL aggregator for DeFi (Decentralized Finance) with information on hundreds of protocols. Their focus on data accuracy and transparencymakes them the go-to site for on-chain comparison and research. In this article, we'll offer you a beginner’s guide to DefiLlama and some of its important research tools.

TVL: A good place to start your research is with TVL. See below the menu bar on the right, beginning with Chains, we can compare the size of each blockchain project using the TVL metric.

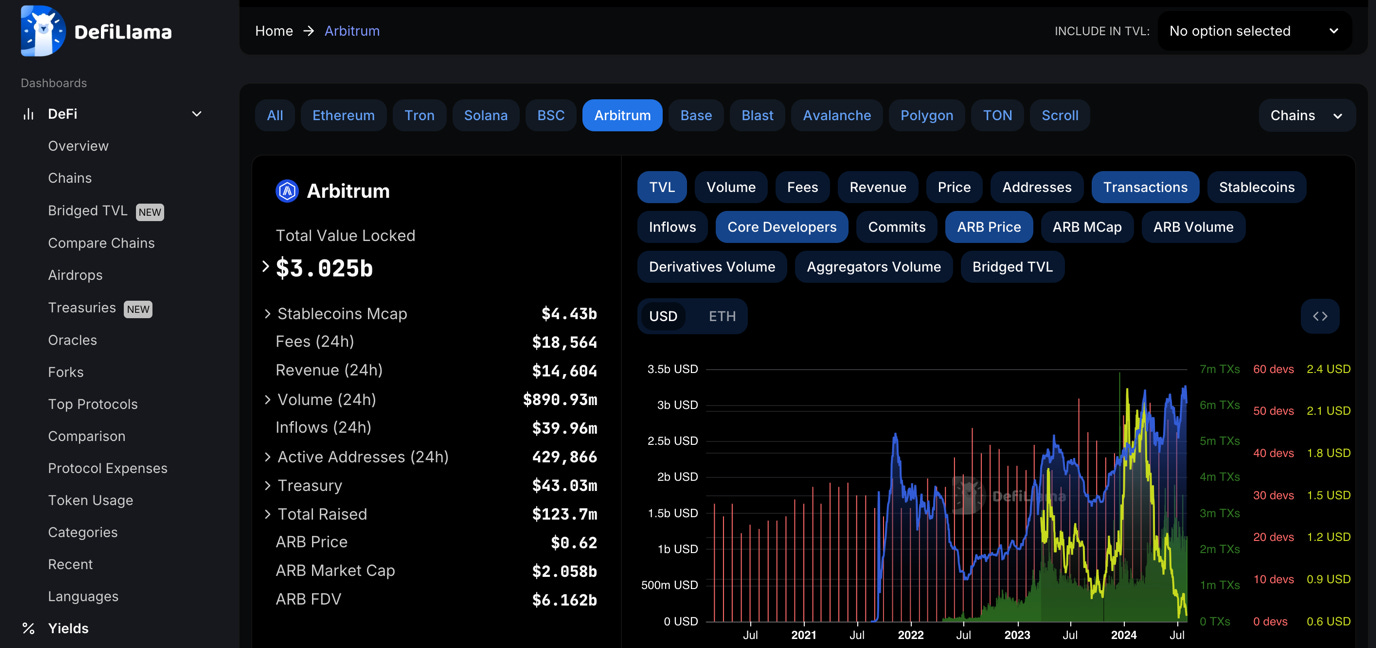

Going deeper into a specific chain, for example Arbitrum, it is possible to monitor many important metrics. Below, some important metrics are highlighted: TVL, transactions, Core Developers, and Price. Positive trending metrics provide crucial information when deciding to invest into specific projects.

DeFi Protocols are the best way to activate your tokens. See below on the list: Lending (ie. Aave), Staking, re-staking, liquid staking, liquid re-staking (ie. Lido, EigenLayer), Dexes (ie. UniSwap), Yield (ie. Convex), RWA, derivitives, synthetics, and even Wallets.

Let’s take a closer look at some information provided regarding protocols launched on Arbitrum.

Top projects for lending (AAVE), Dexes (Uniswap), Restaking (Renzo), Yield Aggregators (Beefy, OpenWorld) can be compared. Here is where you can put your tokens to work.

Let’s take a look at derivative protocol comparison on Arbitrum for additional information. Below are the top two protocols for derivatives (Vertex & GMX) and a newly launched protocol (OpenWorld).

When choosing which protocol to activate your investments on, it is important to see TVL for strength and security, but it is possible to use DefiLlama to recognize those juicy newer projects too. Let’s see what DefiLlama has to say about OpenWorld.

Above are important links to the most necessary cross-checks. You can find direct links to the website, twitter feed, audit information, token addresses, developer activity and competitors. For such a small project only launched in mid-July 2024, there is quite a lot of useful information! With crypto projects, it is important to use these links as they are a sure-fire way to avoid scamming.

DefiLlama is an essential tool for anyone looking to navigate the complex world of DeFi, learn about protocol tools and uncover high-potential crypto projects. By leveraging the platform's extensive data and powerful analytics, you can gain a deeper understanding of the DeFi landscape and make informed investment decisions. Remember to always conduct thorough research and practice proper risk management when investing in any project, and use DefiLlama's insights to complement your own analysis and strategies.

About OpenWorld

The OpenWorld Portfolios allow you to invest into a diversified portfolio of high-yield, low-risk liquidity pools, and does all of the rebalancing, keeping you in range, and auto-compounding for you. You can invest using one token, like USDT, and it will automatically diversify you into the various liquidity pools. We also offer other decentralized finance products that allow you to lend and borrow crypto.

Currently, OpenWorld operates on Arbitrum, and will soon expand to more blockchains. To contact us regarding partnerships or other opportunities, please email us at support@owfin.io, join our Telegram community, and follow us on Twitter.